unlevered beta - delivered beta calculatorunlevered beta - delivered beta calculator Descubra a plataforma unlevered beta - delivered beta calculator, Beta measures a stock's unlevered volatility beta orthe degree to which its price fluctuates relative to the market as a whole. Learn how to calculate beta, the difference between levered and unlevered beta, and how to interpret beta . .

unlevered beta - delivered beta calculator Beta measures a stock's unlevered volatility beta orthe degree to which its price fluctuates relative to the market as a whole. Learn how to calculate beta, the difference between levered and unlevered beta, and how to interpret beta .

betze é confiávelbetzy8 plataforma unlevered beta - delivered beta calculator, Pesquise reputação de empresas antes de comprar. Se tiver problema, reclame e resolva rápido. Toda empresa tem problema, boa é aquela que resolve.

23 de fev. de 2024 · Amazon Prime Video. Two years after the hit Amazon Prime Video superhero series aired its Season 3 finale, “ The Boys ” will finally be back in town. The fourth season of Amazon’s Emmy .

Descubra a plataforma unlevered beta - delivered beta calculator, Beta measures a stock's unlevered volatility beta orthe degree to which its price fluctuates relative to the market as a whole. Learn how to calculate beta, the difference between levered and unlevered beta, and how to interpret beta . .

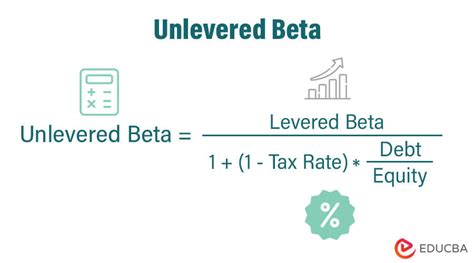

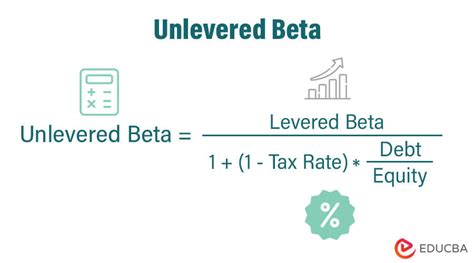

unlevered beta*******Learn how to calculate unlevered beta (asset beta), the volatility of returns for a company without debt, and how to use it in valuation and financial modeling. See Excel examples, formulas, and graphs of beta. Unlevered beta isolates a company's asset risk by excluding the impact of debt, providing a clearer understanding of its inherent market risk. Unlevered beta is derived from levered beta, tax rate, and debt-to-equity ratio, .

unlevered beta Beta measures a stock's volatility or the degree to which its price fluctuates relative to the market as a whole. Learn how to calculate beta, the difference between levered and unlevered beta, and how to interpret beta .

unlevered beta Learn how to calculate and interpret beta (β), a measure of systematic risk, for levered and unlevered securities. Find out the difference between levered and unlevered beta, . Unlevered beta quantifies a company's market-related volatility independently of its debt. This metric calculates the firm's risk based solely on its assets, dissociated from debt considerations. Unlevered beta . Levered beta measures a company’s market risk with debt, while unlevered beta removes debt impact. Choose the right beta to match your financial strategy for success. Understanding the distinction between levered . Learn how to calculate unlevered beta, a metric that measures the volatility of a stock against a market index, using the unlevered beta formula. Compare the unlevered betas of different companies and .

unlevered beta Unlike levered beta, which takes into account the impact of debt on a company’s risk profile, unlevered beta provides a more accurate measure of a company’s intrinsic risk. To calculate unlevered beta, investors . Learn the difference between unlevered beta and levered beta, and how they measure the risk of a security or portfolio. Unlevered beta is the volatility of the company's stock price relative to the market, while levered .However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt). Many different betas can be calculated for a given stock. The main common variables that affect beta calculations are the time period, the reference date, the sampling frequency for closing prices and the reference index.Der Beta ist sehr oft benutzt für Unternehmensbewertung mit der diskontierter Einnahmeüberschuss (DCF) Methode. Der Diskontsatz ist berechnet mit der gewichteter durchschnittlicher Kapitalkostensatz (WACC) Methode. Ein anderer Beta benutzt für Unternehmensbewertung ist der unlevered Beta. Unleved Beta: 자본 비용에서의 역할 이해. 1. Unlevered 베타 소개. 1. 언레버리지 베타: 자본 비용의 중요성 소개. 자산 베타라고도 알려진 언레버리지 베타는 기업의 자본 비용을 결정하는 데 중추적인 역할을 하는 금융의 중요한 개념입니다. 이는 회사의 자본 구조나 부채 조달과 관계없이 특정 투자 또는 .Das Unlevered Beta soll nicht der Bewertung eines einzelnen Unternehmens dienen, sondern ein möglichst genaues Beta für eine Vergleichsgruppe (engl.: „Peer Group“) ermöglichen. Beispiel für Levered vs. Unlevered Beta. Das Unternehmen A soll von einem Analysten bewertet werden.

unlevered beta

Como o Unlevered Beta pode ajudar um investidor? O beta desalavancado remove quaisquer efeitos benéficos ou prejudiciais obtidos ao adicionar dívida à estrutura de capital da empresa. A comparação dos betas desalavancados das empresas dá clareza ao investidor sobre a composição do risco assumido ao comprar as ações.

unlevered beta Il beta unlevered è un modo per confrontare il rischio connesso all’investimento in una particolare azienda con il rischio di investire nell’intero mercato. Unlevered significa che il debito viene rimosso dal calcolo. Ciò a sua volta rimuove gli effetti della leva finanziaria e fornisce quindi un quadro più accurato del rischio comparativo.Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).Unlevered beta, også kendt som unlever beta eller asset beta, er et vigtigt begreb inden for finansverdenen. Det bruges til at måle en aktivs risiko på markedet, uden at tage højde for gæld eller gearing. I denne artikel vil vi dykke ned i hvad unlevered beta er, .Beta del debito netto / Beta esente da debiti (Beta Unlevered) FERRARI ([#TICKER#] | NLD) Il beta è una misura rilevante della volatilità. FERRARI possiede un beta di N/A. Questo valore è significativamente inferiore a 1. La volatilità di FERRARI secondo questo criterio è significativamente inferiore alla volatilità del mercato. The calculation begins with the unlevered beta, representing the business risk devoid of financial leverage. This metric is then adjusted by incorporating the company’s debt-to-equity ratio, reflecting how much debt contributes to the overall risk. Specifically, the formula is: Levered Beta = Unlevered Beta x (1 + (Debt/Equity) x (1 – Tax .Unlevered-Beta; 指標分類: 成長性: 意味: 一般的なβ値であるレバードベータから財務レバレッジの影響を除いた指標。資本構成(資本と負債の割合)による財務リスクを取り除き、事業リスクのみを反映した株価の期待リターンを示す。 Was ist Unlevered Beta? Beta ist ein Maß für das Marktrisiko. Unlevered Beta (oder Asset Beta) misst das Marktrisiko des Unternehmens ohne die Auswirkungen von Schulden. Das „Enthebeln“ eines Beta beseitigt die finanziellen Auswirkungen der Hebelwirkung und isoliert so das Risiko, das ausschließlich auf die Vermögenswerte des Unternehmens .

unlevered beta Levered/Unlevered Beta von Deutsche Bank AG ( DBK | DEU) Der Betafaktor ist eine bedeutsame Kennzahl von Volatilität. Deutsche Bank AG zeigt einen Beta von 1.14. Dies is etwa höher als 1. Die Volatilität von Deutsche Bank AG nach dieser Kennzahl is etwa höher als die Volatilität von der Börse. Beta (Ref: DAX 40)

unlevered beta However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt). Many different betas can be calculated for a given stock. The main common variables that affect beta calculations are the time period, the reference date, the sampling frequency for closing prices and the reference index.Levered Beta就是公司实际的Beta,考虑了公司资本结构。而Unlevered beta是一种假想情况:假设这个公司没有杠杆的情况下Beta是多少。既然是假的,那Unlevered Beta有什么用呢? 这里引入一个问题,如何确定非上市公司的Beta?寻找相似业务的上市公司的beta作为参考。我们知道β系数也称为贝塔系数(Beta coefficient),是一种风险指数,用来衡量个别股票或股票基金相对于整个股市的价格波动情况。 . 公司去杠杆的 β(unlevered β)进行加权平均,得到这个行业赛道所有公司的无杠杆的β(unlevered β),这正是我们需要的数据。Guide to Beta Formula. Here we learn how to calculate beta using top 3 methods along with practical examples and downloadable excel template.

unlevered beta 加重平均資本コスト(Weighted Average Cost of Capital: WACC)算定の実務におけるファーストステップとして、評価対象会社の類似上場企業を選定するステップがあります。その類似会社のマーケットデータ・財務データ

Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).Der Beta ist sehr oft benutzt für Unternehmensbewertung mit der diskontierter Einnahmeüberschuss (DCF) Methode. Der Diskontsatz ist berechnet mit der gewichteter durchschnittlicher Kapitalkostensatz (WACC) Methode. Ein anderer Beta benutzt für Unternehmensbewertung ist der unlevered Beta.Unlevered beta (or ungeared beta) compares the risk of an unlevered company (i.e. with no debt in the capital structure) to the risk of the market. Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta.

Unlevered beta (or ungeared beta) compares the risk of an unlevered company (i.e. with no debt in the capital structure) to the risk of the market. Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta.Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).Unlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).

Muitos exemplos de traduções com "unlevered" – Dicionário português-inglês e busca em milhões de traduções. unlevered - Tradução em português – Linguee Consultar o LingueeUnlevered beta is useful when comparing companies with different capital structures as it focuses on the equity risk. Unlevered beta is generally lower than the levered beta. However, unlevered beta could be higher than levered beta when the net debt is negative (meaning that the company has more cash than debt).