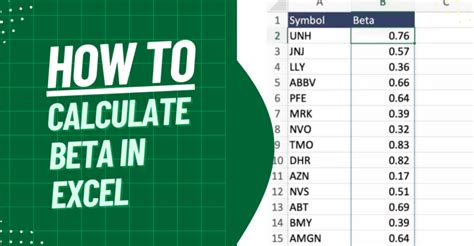

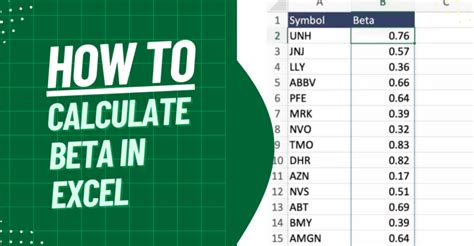

how to calculate beta in excel - beta in excel formulahow to calculate beta in excel - beta in excel formula Descubra a plataforma how to calculate beta in excel - beta in excel formula, Learn how to use how Excel to formulas calculate and beta linear in regression excel tocompute beta, a measure of stock volatility relative to a benchmark index. See examples, methods, and interpretations of beta for investors. .

how to calculate beta in excel - beta in excel formula Learn how to use how Excel to formulas calculate and beta linear in regression excel tocompute beta, a measure of stock volatility relative to a benchmark index. See examples, methods, and interpretations of beta for investors.

windguru cabareteWind, waves & weather forecast Cabarete Windsurfbeach how to calculate beta in excel - beta in excel formula, This is the wind, wave and weather forecast for Cabarete in Puerto Plata, Dominican Republic. Windfinder specializes in wind, waves, tides and weather reports & forecasts for wind related .

Resultado da 8 de nov. de 2023 · Acompanhe o sorteio da Lotofácil 2949 e confira o resultado do dia 08 de novembro de 2023, quarta-feira, com o prêmio de hoje estimado em R$ 1.700.000,00 (um milhão e setecentos mil reais). . 750, e o resultado da Lotofácil 2949 divulgado a partir das 20:00 horas no painel .

Descubra a plataforma how to calculate beta in excel - beta in excel formula, Learn how to use how Excel to formulas calculate and beta linear in regression excel tocompute beta, a measure of stock volatility relative to a benchmark index. See examples, methods, and interpretations of beta for investors. .

how to calculate beta in excel*******O uso do Excel para o cálculo beta requer dados específicos e um guia passo a passo sobre o uso de fórmulas do Excel para obter resultados precisos. A interpretação dos resultados beta . To calculate beta in Excel, you will need to gather historical price data for the stock you are interested in, as well as for the market index you are using as a benchmark. You will need at least 24 monthly price .

how to calculate beta in excel Learn how to use Excel formulas and linear regression to compute beta, a measure of stock volatility relative to a benchmark index. See examples, methods, and interpretations of beta for investors.The beta formula measures a stock's volatility relative to the overall stock market. It can be calculated using the covariance/variance method, the slope method .

how to calculate beta in excel Learn how to use Excel functions and formulas to calculate beta, a measure of stock volatility relative to a benchmark index. Find out how to interpret beta and use it in your investment strategy. Formula for Calculating Beta: Beta= Covariance of the portfolio returns with the expected returns / Variance of the portfolio returns. Step 1 – Prepare Outline and Dataset. Create a dataset containing Portfolio .

how to calculate beta in excel Learn how to calculate beta (β), a measure of stock volatility relative to the market, using three methods: variance/covariance, slope and regression. Download historical stock and index data, use Excel functions and . Learn how to use Excel formulas to measure the volatility or risk of an asset relative to a benchmark. Find out the issues with beta and how to calculate a project beta using the pure play method.

Learn how to use Excel functions and formulas to calculate the beta of a stock, a measure of its volatility in the market. Follow step-by-step instructions with examples and screenshots. Common Mistakes to Avoid When Calculating Beta in Excel. When calculating beta in Excel, there are several common mistakes to avoid. For example, using incorrect data or assumptions can lead to incorrect results. In . Beta is a useful tool for calculating risk, but the formulas provided online aren't specific to you. Learn how to make your own using Excel.Organize the data and open the Regression calculator. Select the stock price returns as the “Input Y Range.” Find the Beta value in the Coefficients column of the Summary Output sheet. In Conclusion. In conclusion, mastering the . How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance)Subscribe!What is BetaA stock that swings more than the market over time has a.

In this video, we’ll take a deep dive into the world of beta calculation and explain how to calculate it in Excel. We’ll also provide some tips and tricks wh.In this tutorial, we will go through the process of calculating beta using regression in Excel. A. Formula for calculating beta using regression results. When using regression analysis to calculate beta, the formula is as follows: Beta (β) = Covariance (Market Return, Stock Return) / Variance (Market Return)Calculating beta in Excel is a useful skill for investors looking to analyze and assess the risk associated with a particular stock. By following the basic principles outlined above and leveraging Excel’s functions, investors can easily compute beta values to make informed investment decisions based on risk and return characteristics.

Calculating Beta In Excel Using The SLOPE Function . Before we calculate the beta of a stock using the Excel function, we'll need to gather the necessary data. This includes the historical prices of the stock you’re looking at and the market's historical performance. In this article, we discuss what beta is and how to calculate it in Excel. Related jobs on Indeed. Part-time jobs. Full-time jobs. Remote jobs. Urgently hiring jobs. View more jobs on Indeed. What is beta? Beta is a way that investors calculate the volatility of a stock compared to the rest of the market.

Step 4. Calculate Variance. To calculate the variance of the index/benchmark in Excel as per our formula to calculate Beta, we use the =VARI.S(val) formula of Excel, which calculates the variance of a sample.. To apply it, we do so by typing the formula name or selecting it .Method 1: Slope function. This is the quickest method and works as follows: Choose an empty cell and enter =slope to trigger Excel’s slope function.; For known_ys, choose the returns on the security you’re interested in.; For . The higher or lower the beta value is, the riskier it is to invest in that particular stock. So, when you calculate a stock's beta using Excel or any other method, it is essential to consider how risky the stock is before investing . Beta is the most important tool to measure companies' risk. Before choosing stock for investment purpose, investors are always advised to measure the volatil.Alright, now that you know how to calculate portfolio beta manually, let’s see how we can calculate it on Excel. You can calculate portfolio beta on Excel using the “SUMPRODUCT” function. Excel’s “SUMPRODUCT” essentially takes the sum of multiple products (being the value of 2 numbers multiplied by one another).

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch11.xlsxDownload PowerPoints: https://people.highline.edu/mgirvin/YouTubeE. Introduction to Calculation of Beta in Excel. Beta is a widely used measure of a stock’s volatility in relation to the stock market, represented by a beta value.It is a crucial metric for investors who want to understand how much risk they are taking on when investing in a particular stock, also known as a stock’s beta coefficient. This Excel spreadsheet calculates the beta of a stock, a widely used risk management tool that describes the risk of a single stock with respect to the risk of the overall market. Beta is defined by the following equation. where r s is the return on the stock and r b is the return on a benchmark index.. What Does Beta Mean for Investors? A stock with a beta ofIn financial analysis, beta aids in evaluating risk and return. A low beta implies a stable investment, ideal for risk-averse investors. Conversely, high beta stocks can offer higher returns but come with increased risk. How to Calculate Beta in Excel. Embarking on the journey of calculating beta in Excel might seem daunting, but fear not.

In this video tutorial, we explain how to calculate beta in Excel, using four different methods.0:00 Introduction0:17 Preparing the data needed3:39 Method 1:.

Method 2 – Calculate Beta using excel’s slope function. Beta = SLOPE(range of % change of equity, range of % change of index). Next Lesson. Data Science in Finance: 9-Book Bundle. Master R and Python for financial data science with our comprehensive bundle of 9 ebooks. What's Included:

In this tutorial, we will walk through the steps of calculating beta using Excel. A. Using the formula to calculate beta. Step 1: Gather stock and market data; The first step in calculating beta is to gather the historical price data for the stock in . Calculating beta in Excel can be a valuable tool for investors and financial analysts. It provides insights into a stock’s volatility and its relationship to the overall market. By following the step-by-step guide outlined in this blog post, you can easily calculate beta in Excel using historical price data. This article focuses on CAPM Beta - its Definition, Formula, Calculate Beta in Excel. Learn how to calculate Beta, Unlevered Beta and Levered Beta. All Courses . Login. Sign In. All Courses. Trending Courses. . This video discusses how to obtain stock alpha and beta in Excel. I go through an example using the slope and intercept function and using Excel's regression.

In this guide, we'll demonstrate how to calculate species richness within Excel and discuss why Sourcetable offers a more user-friendly alternative for ecologists. . The Diversity Calculator is an Excel template designed to compute alpha-, beta-, and gamma diversity. This tool facilitates the analysis of species diversity, .

Ryan O'Connell, CFA, FRM explains how to estimate the beta of a stock in excel. 🎓 Tutor With Me: 1-On-1 Video Call Sessions Available Join me for personali. Calculating beta in Excel can be done using various methods, including regression, covariance, and variance. The method chosen will depend on what data is available and the user’s preference. It is important to note that beta is just one measure of risk and should not be used in isolation when making investment decisions.