debt beta formula - The capital asset pricing model – part 1 debt beta formula - The capital asset pricing model – part 1 Descubra a plataforma debt beta formula - The capital asset pricing model – part 1 , Debt beta is used in debt case beta of formula calculatingbeta of the firm. It is used in the following formula: Asset Beta = Equity Beta / (1+ [(1 – Applicable Tax Rate) (ratio of debt to equity)] .

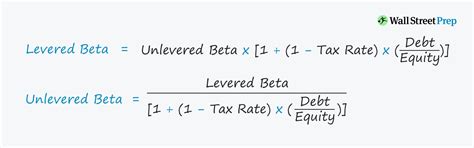

debt beta formula - The capital asset pricing model – part 1 Debt beta is used in debt case beta of formula calculatingbeta of the firm. It is used in the following formula: Asset Beta = Equity Beta / (1+ [(1 – Applicable Tax Rate) (ratio of debt to equity)]

bet365 card365bet ao vivo debt beta formula - The capital asset pricing model – part 1 , Når det er finansieret, fungerer dit bet365 Mastercard som ethvert andet .

Resultado da JOGOS VIRTUAIS! (APENAS TERÇAS-FEIRAS) Receba de volta uma percentagem das suas apostas perdidas em Bónus para novas jogadas em Jogos Virtuais: Bónus elegíveis para uso em todos os desportos .

Descubra a plataforma debt beta formula - The capital asset pricing model – part 1 , Debt beta is used in debt case beta of formula calculatingbeta of the firm. It is used in the following formula: Asset Beta = Equity Beta / (1+ [(1 – Applicable Tax Rate) (ratio of debt to equity)] .

debt beta formula*******Learn how to calculate debt beta using the CAPM formula or the credit rating of a company and its industry. Debt beta measures the risk of debt returns and affects the cost of equity and the cost of debt.Debt beta is a measure of the systematic risk of a company's debt, which is used in the capital asset pricing model. Learn how to calculate debt beta, how it differs fro.

debt beta formula Debt beta is used in case of calculating beta of the firm. It is used in the following formula: Asset Beta = Equity Beta / (1+ [(1 – Applicable Tax Rate) (ratio of debt to equity)]

debt beta formula This article addresses computing and using debt beta when deriving the unlevered beta (Bu), the all-equity cost of capital (Ku) and the WACC. I describe how you can compute the debt beta .Learn how to calculate the weighted average cost of capital (WACC) with debt beta using CAPM and avoid the common mistake of assuming zero debt beta. See how WACC varies with leverage and enterprise value, and why firms do .

debt beta formula βi = beta value for financial asset. E (rm) = average return on the capital market. This formula expresses the required return on a financial asset as the sum of the risk-free rate of return and .Assuming the debt beta is zero, the asset beta formula becomes: If the equity beta, the gearing, and the tax rate of the proxy company are known, this amended asset beta formula can be . The Hamada equation is calculated by: Dividing the company’s debt by its equity. Finding one less the tax rate. Multiplying the result from no. 1 and no. 2 and adding one. Taking the unlevered. where β L is the levered beta, β U is the unlevered beta, β D is the debt beta, t is the corporate tax rate, D is the value of debt, and E is the value of equity. If we assume that β D = 0, then Eq. Levered Beta Formula. Often referred to as the “equity beta”, a levered beta is the beta of a firm inclusive of the effects of the capital structure. Generally speaking, a higher .Erkunden Sie das Thema Das Debt Beta in der Unternehmensbewertung in unserem Information Hub: Das Fremdkapital-Beta ist ein Maß für die Sensitivität des Eigenkapitals gegenüber Veränderungen in der Fremdfinanzierung und wird aus dem Verhältnis des Kreditspreads zur Eigenkapitalrisikoprämie abgeleitet. Es dient als Indikator für das systematische Risiko, wie es .

debt beta formula Beta Formula. The beta formula is relatively simple. It is calculated using two specific components, covariance and variance. . Levered beta considers the company's debt and equity, while unlevered beta isolates .Es wird eine Methode innerhalb des stetigen CAPM präsentiert, die auf dem Verständnis beruht, dass Eigen- und Fremdkapital als Optionen auf den Wert des unverschuldeten Unternehmens betrachtet werden können. Diese Methode zielt darauf ab, das Debt Beta konsistent zu ermitteln. Lesen Sie hier den kompletten Fachartikel.Debt beta is a measure of the *systematic* risk of debt securities. . I believe your derivation assumes that the riskiness of the tax shield flows equals the riskiness of debt. If your formula leads to the conclusion that increasing leverage sometimes increases WACC (producing the WACC “smile”), then it must be incorrect.

debt beta formula Beta is a measure of potential risk; riskier investments come with a higher beta. While the statements above are clipped definitions, they give a brief overview and help to explain why Hamada’s equation is a sort of hybrid between the two theorems. How Hamada’s Equation Works. A levered firm is one that is financed by both debt and equity.

debt beta formula Harris–Pringle with zero debt beta (practitioners formula) The Harris–Pringle formula can be further simplified with an additional assumption of no default risk on debt—i.e. : β D = 0: This formula is often referred to as the ‘practitioners’ formula because it requires fewer variables to be estimated than in the other formulas. Capital Structure Mix → The capital structure (debt/equity ratio) of companies also progressively changes over time, which can alter their risk profiles and performance. . Yes, the beta in the CAPM formula is levered beta. BB. 1. Reply. Analyst November 28, 2022 9:09 pm Reply to Brad Barlow Thanks Brad! 1. Reply. Brad BarlowAfter unlevering the stock, the beta drops down to 1.07, which makes sense because the debt was adding leverage to the stock returns. Stock 2 has no cash and no debt, so the equity and asset betas are the same. This makes perfect sense since there is no capital structure impact on the returns. Stock 3 has a net cash position (negative net debt .Unlevered Beta Formula Derivation . General information Hi all, Would like to clarify why tax shield effect (1-t) in the unlevered beta formula is applied to the total debt (or debt/equity ratio) as isnt the tax shield effect only on a portion of the debt . Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity = $150 Billion / $50 Billion = 3.0 This result indicates that XYZ Corp has $3.00 of debt for every dollar of equity. Why is the D/E Ratio . Unlevered Beta – Formula and Salient Points. The formula to calculate the unlevered beta is: Unlevered Beta (βa) = Levered Beta (β e) / [1 + ((1-Tax Rate) * (Debt/Equity (D/E) Ratio))] To calculate the unlevered beta of a .

debt beta formula Unlevered Beta: Definition, Formula, Example, and Calculation. By Akhilesh Ganti. Updated October 24, 2024. . Unlevered beta strips off the debt component to isolate the risk due solely to .function of the unlevered beta and the debt-equity ratio! β L = β u (1+ ((1-t)D/E))! In some versions, the tax effect is ignored and there is no (1-t) in the equation.! Debt Adjusted Approach: If beta carries market risk and you can estimate the beta of debt, you can estimate the levered beta as follows:! β L = β u (1+ ((1-t)D/E)) - β debtGuide to Levered Beta Formula. Here we discuss how to calculate Levered Beta along with practical examples and downloadable excel template.

debt beta formula This formula shows that levered beta is always greater than or equal to unlevered beta. The higher the company's debt-to-equity ratio and cost of debt, the higher its levered beta will be. Implications for Investors. Investors should be aware of the different types of beta and how they are calculated when making investment decisions. It can be observed that higher financial leverage increases equity beta. However, the relationship between the unleveraged asset or enterprise beta (the beta of the underlying operating business), and leveraged equity beta that is commonly applied in practice, is incomplete. We explain the relevance of asset betas in equity valuation and why it is important .As a company gears up, the asset beta remains constant, even though the equity beta is increasing, because the asset beta is the weighted average of the equity beta and the beta of the company’s debt. The asset beta formula, which is included in the formulae sheet, is as follows: If a company increases its debt to the point where its levered beta is greater than 1, the company's stock is more volatile than the market. If a company decreases its debt to the point where its .

debt beta formula a. Practitioner’s method vs Risky-debt formula. Unlevering and relevering beta in WACC may be done in a number of ways. A method employed by practitioners gives the relationship between unlevered and relevered beta as follows: Levered Beta = Unlevered Beta * (1+D/E), where D/E = Debt-to-Equity Ratio of the company. The following is the formula for calculating β: Beta = Covariance (Returns on stock, Returns on Market) / Variance(Returns on market) There are a few steps to calculate β. They are: Step 1: Collect Historical Data. Download historical security prices for the asset's β you want to calculate. . (Debt and equity mix).

debt beta formula Die exakte Ermittlung des Debt Beta ist somit mit diversen Einschätzungen und Parametern verbunden. Diese Komplexität ist auch einer der Hauptgründe für die bisher geringe Verbreitung der Anwendung. Verschuldung und Debt Beta. Trotz der Komplexität der Ableitung ist bei steigenden Verschuldungsgraden die Anwendung des Debt Beta zu empfehlen.About Levered Beta Calculator (Formula) In the world of finance, beta is a key measure used to determine the risk of an investment relative to the market. . How does debt affect Levered Beta? Increased debt typically raises Levered Beta, indicating higher risk and volatility due to .

debt beta formula Guide to what is Equity Beta. We explain its formula, differences with asset beta, how to calculate it with examples & interpretation. Because debt is assigned a beta of its own using the Harris-Pringle formula, it more accurately accounts for the riskiness inherent in carrying debt and leverage. The debt beta accounts for the likelihood, however slim, that either interest or principal payments go unpaid or .

debt beta formula Beta denotes volatility, . Unlevered Beta: Definition, Formula, Example, . Unlevered beta (or asset beta) measures the market risk of the company without the impact of debt. more. Portable . Unlevered Beta is basically a weighted average of the levered Beta and the debt Beta. Typically, the debt beta is thought to be 0, although it isn't always. Ub = [(1-L)Eb + (L)DB]/ (1 - TL) That's the general formula for conversion, with Ub being the unlevered (or Asset) beta, Eb being the levered (or equity) beta, and Db being the debt beta.

我们知道β系数也称为贝塔系数(Beta coefficient),是一种风险指数,用来衡量个别股票或股票基金相对于整个股市的价格波动情况。每个公司的财务杠杆,也就是负债Debt水平不一样,会给该公司股价的市场波动带来不一样的影响,直接的表现就是同一行业、同一赛道的peer公司的杠杆β(levered β)会 .