are cfds spread betting - cfd vs spread bettingare cfds spread betting - cfd vs spread betting Descubra a plataforma are cfds spread betting - cfd vs spread betting, In spread betting and are CFD cfds trading, spread the betting spreadis the difference between an asset's ask (buy) and bid (sell) price. Spread betting will have a more extensive spread . .

are cfds spread betting - cfd vs spread betting In spread betting and are CFD cfds trading, spread the betting spreadis the difference between an asset's ask (buy) and bid (sell) price. Spread betting will have a more extensive spread .

winchile opinionesReseña imparcial WinChile Casino 2024: Información completa are cfds spread betting - cfd vs spread betting, Winchile casino — reseña y opiniones. Anacaona Florentino •. Aviso de publicidad. • Actualizado en Octubre 30, 2024 • Revisado por Dasha G. 66/100 Nota del .

Válido é sinônimo de: apropriado, benéfico, conveniente, opo.

Descubra a plataforma are cfds spread betting - cfd vs spread betting, In spread betting and are CFD cfds trading, spread the betting spreadis the difference between an asset's ask (buy) and bid (sell) price. Spread betting will have a more extensive spread . .

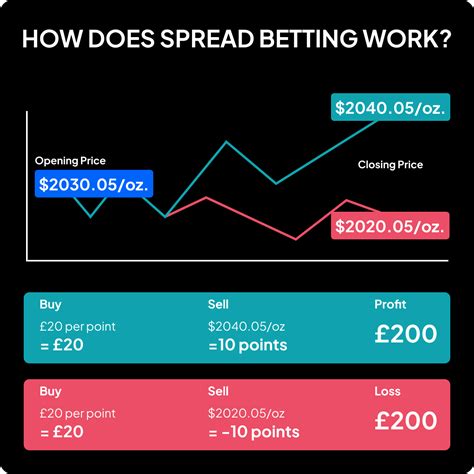

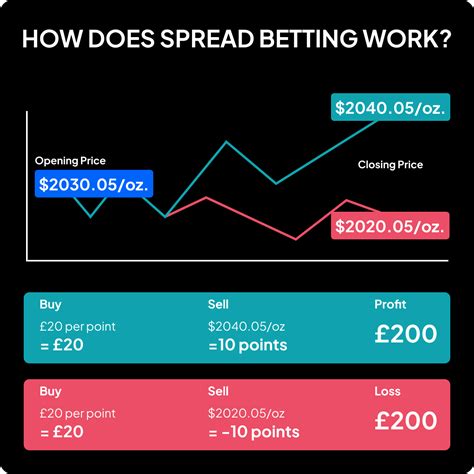

are cfds spread betting*******Spread betting and CFD trading are leveraged trading products that offer many of the same benefits. They're similar in that they're both margined products. This means you can open a .The key difference between spread betting and CFD trading is how they are taxed. Spread bets are free from capital gains tax, while profits from CFDs can be offset against losses for tax purposes. You don't pay stamp duty with either . In spread betting and CFD trading, the spread is the difference between an asset's ask (buy) and bid (sell) price. Spread betting will have a more extensive spread .

are cfds spread betting Learn about the key differences between spread betting and CFD trading, discover the pros, cons and risks of both to help decide which product is right for you. Spread bets and CFDs are complex instruments and .

are cfds spread betting Trading Contracts for Difference (CFDs) provides a flexible method for speculating on financial markets. Unlike spread betting, which involves placing bets on price directions, CFDs entail .

are cfds spread betting Spread betting and CFD (Contract for Difference) trading are two prominent methods for trading shares, forex, commodities, and other financial instruments. These approaches are widely recognized for their prevalence in the trading .CFDs and spread betting are both examples of leveraged products that provide large market exposure for a small initial deposit. Learn which trading method suits your investment style CFDs (Contracts for Difference) are derivative products where a trader agrees to exchange the difference in an asset’s price from the moment the position opens to .

CFDs and spread betting are so similar – what are the differences? There is no expiration on a CFD, whereas there is with spread betting. The latter has set expiration dates.

Start Spread Betting today and take your trading to the next level. Tax-free profits - Pay no capital gains tax on your profits (UK only) ; Dedicated support - A regulated brokerage to guide you, while answering any questions, providing a better trading experience and pushing you towards success ; Trade both ways – Take advantage of opportunities when markets are moving both higher or .Unlike CFDs, where you trade lots, spread betting involves placing a specific amount of money on the direction of price movements. In spread betting, you choose an amount to bet per point of movement, known as your 'stake' size. For example, if you bet £1 per point, . When considering “CFDs and Spread Betting” for trading and price predictions, remember that trading CFDs and Spread Betting involves a significant degree of risk and could result in capital loss. Past performance is not indicative of any future results. 68% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets, CFDs, OTC options or any of our other products work and whether you can afford to take the high risk of losing your money. 68% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets, CFDs, OTC options or any of our other products work and whether you can afford to take the high risk of losing your money.

Trade rising or falling markets in a tax-efficient way with spread bets on markets.com. You can trade thousands of instruments, across forex, commodities, currencies and stocks and in global markets. Spread bets are a leveraged product, like CFDs, yet are exempt from Capital Gains Tax or Stamp Duty on profits from spread betting within the UK.Spread betting CFDs; Tax-efficiency: No stamp duty, No Capital Gains Tax (CGT) in the UK* No stamp duty, Capital Gains Tax (CGT) liable: Our charges: No commission, just our spread: Commission charged only on CFD equity trades. Razor account - raw spread with commission.

Spread betting and CFDs (contracts for difference) are similar in how they work, allowing you to speculate on a financial instrument without owning the underlying market. The key difference is how they are taxed. Spread betting is tax free, as you don’t have to pay capital gains tax on profits or stamp duty since you don’t take ownership of the underlying asset. . Financial Spread Bets and CFDs are complex instruments and come with a .

While CFDs can be traded directly in the market, this is not the case with spread betting. Spread bets can only be placed through a broker over the counter. Spread betting does not involve commission or trading fees; meanwhile, CFD trading is treated more like any other instrument where traders pay a transaction fee or commission fee.Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should .So with both spread betting and CFDs: You bet on the price changes of a market; You bet on the exact same financial markets; You don't own anything (meaning you don't get charged stamp duty) Both products are tradable on margin. Are regulated by the . The main difference between Spread Betting and CFDs is the context of how you place an order. With CFDs, you select a Lot size or volume of units. For example 1 Lot or 100,00 EUR/USD. Whereas, with Spread Betting .

Spread betting offers a unique approach to trading, with its own set of advantages and disadvantages. Advantages: Tax Efficiency: In many jurisdictions, profits from spread betting are exempt from capital gains tax, making it an attractive option for an investor. Leverage: Like CFDs, spread betting lets traders use leverage to magnify profits.Spread betting and CFDs can be used on most financial markets such as forex, stocks, indices, commodities, bonds, ETFs and more. There are some distinct differences between spread betting vs CFD trading relating to tax, the type of accounts available, how they are priced and more.Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investors lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Spread betting and CFDs differ in stake calculations, tax implications, costs, and spreads. Residents of the UK and Ireland don’t pay capital gains tax on profits gained with spread betting, while CFDs offer traders the ability to . Spread betting forex is a tax-free* method of trading the currency markets. Traders are able to speculate on the price movements of currency pairs by opening a position based on whether they think the currency will appreciate or depreciate. If you expect the value to rise, you would open a long or ‘buy’ position, or if you expect the value to fall, you would open .

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investors lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Because forex CFDs and spread betting are derivatives, you never own the underlying market, exempting you from paying stamp duty on your purchases. This is useful as it saves you from extra costs associated with trading. 3. . Spread Betting is a derivative strategy where traders bet on the direction of price movements of an asset. Like CFDs, traders do not own the underlying asset.

Spread betting, CFDs, forex, and traditional shares and funds are all included in this category. Over 17,000 spread betting markets are available to you at IG – that’s a lot. The focus is on forex, indices, shares, and commodities, with a strong focus on forex. Spread betting vs. CFDs. Many spread betting platforms also provide trading in CFDs (contracts for difference), which are a similar type of contract. CFDs are derivative contracts, allowing traders to speculate on short-term price movements. CFDs do not involve delivery of physical goods or securities. Spread Betting vs CFDs. Spread Betting, and CFD trading allow investors to gain unique exposure to the global financial markets. They are both forms of derivative trading that offer similar benefits, such as leverage, a wide range of .As we’ve seen, spread bets are completely tax free under current UK legislation. CFDs are also exempt from Stamp Duty 1 which is payable by investors when they trade UK equities. However, CFDs aren’t exempt from Capital Gains Tax 1 on profits. But the upside of being subject to CGT means that any trading losses can be offset against trading profits.Spread betting is tax-free 2 for the majority of UK residents. Most people won’t pay Capital Gains Tax (CGT) or stamp duty. This means most people would keep 100% of their profits when spread betting, which isn’t the case when trading CFDs.Spread Betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67.3 % of retail investor accounts lose money when trading Spread Betting and CFDs with this provider . Spread betting and CFDs are derivative products that allow you to speculate on the price movements of financial assets without taking ownership. The main difference between the two accounts is how they are taxed. Learn more about each product in our spread betting versus CFDs guide.